US and Global Markets Continue their Positive Momentum

US and global stock markets advanced in the third quarter, with the S&P 500 marking a ninth consecutive quarter of earnings growth. The estimated year-over-year earnings growth rate for the S&P 500 index is 7.7%, while the forward PE ratio is 22.6x, above the 5yr average (19.9x) and the 10yr average (18.5). Gold rose by 16.8% over the quarter, while the world index of stocks rose 7.4% and the US Dollar rose slightly (0.9%). The US economy remains broadly healthy, with US unemployment around 4.2%, CPI Inflation at 2.9% (a slight increase from earlier in the year when inflation was at 2.4%) and US 10year government bond yields around 3.6%.

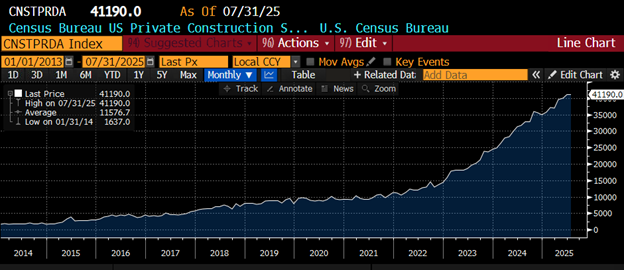

The Technology sector has continued its strong performance since the April 1st “Tariff Tantrum” lows, underpinned by increased data spending growth, carve-outs to tariffs for companies such as Apple and ongoing investment associated with AI. According to Factset, the earnings growth for the sector accelerated to 20% from 16%, while Nvidia, Microsoft and Apple all increased dollar estimated earnings per share for the quarter. The below US Census Bureau US Private Construction of Data Centers index shows how data center construction in the US has increased from around $10billion at the end of 2021 to almost $42billion today. According to Renaissance Macro Research, AI “capex”, defined as information processing equipment plus software has added more to GDP growth than consumer spending.

US Census Bureau US Private Sector Data Center Construction Index

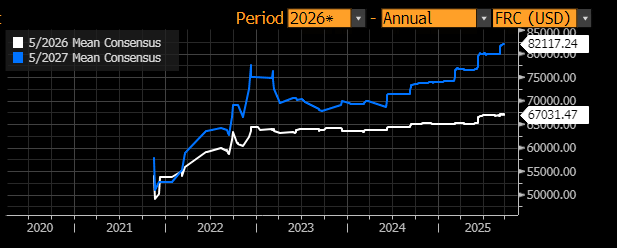

Some of the biggest beneficiaries of this increased spending have been companies providing the infrastructure, such as a Oracle, which rose 29% over the quarter and Arista Networks (+42%). You can see how the market is now estimating Oracle’s 2027 revenues to be $82billion, 35% higher than today. Companies such Arista Networks (high performance computer networking hardware) and GE Vernova (power supply) have similarly seen jumps to expected revenues for both 2026 and 2027.

Graph showing change in Oracle Expected 2026 and 2027 Sales (Bloomberg)

The momentum is very much with this sector. As investors, we are balancing the very good news with regards to earnings and sales growth with valuations- as an example, the price-to sales ratio for the S&P Information Tech sector is now at 10x, higher than during the dot-com bubble. The index is also twice as profitable – with profit margins now at 22% versus 9.9% in 1999. Our goal is to try and hold exposure to those highly profitable companies whilst avoiding the most expensive ones.

S&P 500 tech sector price to sales ratio, 1990 to 2025 (Bloomberg)

Tariffs and Consumer Headwinds

In addition to strong data center spending, Apple benefited from news in early August that it had secured an exemption – as Trump said, “if you’re building in the United States…or have committed to build, there will be no charge”. Many other companies, however, could not secure exemptions, and in the most recent monthly revenue report from the US Treasury, customs duties raised $30billion in August 2025, more than corporate income taxes in the past two months, and more than four times the amount collected in August 2024.

The Yale Budget Lab has estimated that tariff revenue will raise approximately $2.1 trillion over the next decade. These estimates will of course be subject to change. In a paper for the American Enterprise Institute, Kyle Pomerleau and Erica York describe the “excise tax offset” effect of tariffs: essentially, if there is a 25% tax on assets coming into the country, then the remaining tax base of these assets would be 75% of a non-tariff year. It is too early to prove this theory, although the fact that July 2025 federal total tax revenues were only $8billion higher than the previous year, despite $20billlion in new tariff revenues, suggests that there are already “offsets” being employed.

What has emerged in the last quarter is that US companies are baring the brunt of the tariffs. Analysis by Goldman Sachs showed that the burden of tariffs in June fell mostly on US companies- about 64 percent of the total, with US consumers absorbing 22 percent and just 14 percent falling on foreign companies. Goldman Sachs do believe that the eventual burden will fall on consumers, but in the short-term, US companies are having to shoulder the burden. In the last quarter, Costco noted tariff effects raising import costs for 20% of their goods, while Procter and Gamble announced costs in the range of $1billion to $1.5billion (or around 9% of their estimated 2025 profits). Similarly, Nike highlighted rising tariff costs ($1.5billion) in their most recent quarterly call.

For consumer staples’ businesses, particularly foods but also consumer products, the headwinds of tariffs come on top of a decade of slow growth. The sector is expected by Factset to report the second-highest (year-over-year) earnings decline in the quarter of all eleven sectors at -3.1%. At the industry level, 4 of the 6 industries in the sector are projected to report a year-over-year decline in earnings: Food Products (-23%), Household Products (-4%), Personal Care Products (-3%), and Beverages (-1%). On the other hand, two industries are predicted to report year-over-year earnings growth: Tobacco (7%) and Consumer Staples Distribution & Retail (3%).

Food products and household products are areas of the market where valuations are not stretched. Pepsi’s current 4% dividend is higher than at any point since at least 1985, and the same is true of Nestle at 4%. Offsetting the valuation, the momentum continues to look difficult with the 50-day moving average of prices close to dropping below the 200 days. Despite the difficult momentum, we continue to hold exposure.

Pepsi’s Dividend Yield since 1985 (Bloomberg)