Largest Companies Remain Strong

The S&P 500 rose by 5% to touch a new high of 5,505 in the last quarter, driven by stocks such as Nvidia (+33%), Apple (+23%), Alphabet (+21%), Qualcomm (+17%) and Eli Lilly (+16%) as themes such as Artificial Intelligence and the benefits of GLP-1 continue to have a strong influence on the market.

The last quarter witnessed greater disparity in stock market returns than usual, perhaps best illustrated by the divergence between the Nasdaq 100’s return (+8%) and the Dow Jones Industrial Average (-1.3%). Despite declines in the industrial, financial and energy sectors over the quarter, the earnings outlook for many companies remains positive.

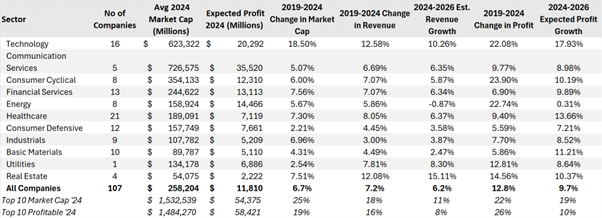

Source: KDT, Marketscreener.com, Change figures are annualised

The above table looks at over 100 US listed companies that we follow which have annual profits in excess of $1billion. Since 2019, these companies have grown in market value by about 7% annualized, in line with the annualized revenue growth in the period and less than the profit growth over the same period. This 6% annualized market value growth rate is half the S&P 500’s annualized growth rate of 13% per annum over the same period- one reason for this disparity is that the S&P 500 is “weighted” towards the largest companies which have done significantly better over the same period.

The ten largest US companies by market value (Apple, Alphabet, Microsoft, Nvidia, Amazon, Meta, JPMorgan, Berkshire Hathaway, Eli Lilly and Broadcom) have seen their market capitalization rise almost four times faster than the group over the last five years, while their sales growth has been more than double each year over the last five years. This group is valued at approximately 30 times their expected 2024 earnings, 50% more than the group at large (21 times earnings). At the same time, the “top ten” is expected to grow its earnings by 19% per annum over the next two years, double that of all companies. Investors are thus paying 50% more for twice the expected growth.

The growth rate of the ten most profitable companies in our group (Apple, Alphabet, Microsoft, Nvidia, Amazon, Meta, JPMorgan, Exxon, Berkshire, Chevron) is in line with the group at large and well below that of the ten largest by market capitalization. This is because analysts expect no earnings growth from the energy sector for the next two years. Ironically, ExxonMobil is the only company to have managed to stay amongst the ten most profitable companies in the US consistently since 1955, despite long periods where earnings growth expectations remained muted.

Generally, we are looking to invest new funds into companies with positive long-term growth expectations, although we remain mindful that incorporating companies with more modest expectations has proven to be beneficial in the longer term.

Uses of Generative Artificial Intelligence in Investing

In early May, KDT spoke with Pascale Belaud, Co-Founder and Chief Operating Officer and Board Member of SynerAI, a private company which raised $1.6million in a seed funding round from Acequia Capital in March 2023. SynerAI is an operator of an artificial intelligence-enabled news comprehension and synthesis platform intended to transform open-source data into new insights. The company’s platform utilises alternative data to produce tools with insights leading to clear actions, providing users with new patterns, insights and investment research and decision support tools.

In addition to his role at SynerAI, Pascal has spent 25 years at Microsoft, most recently as General Manager. His team of over 60 people includes Microsoft Data scientists in charge of building the next generation of Machine Learning models for Microsoft clients across Banking, Insurance and Capital Markets. Technology remains a significant area of investment for the Financial Services industry – last year, JP Morgan spent $15billion, or 17% of non-interest expense, on Technology.

Pascal, over the course of the conversation, explained that while “AI” is the short-hand term used to describe the latest advances in computing, the correct technical term is “Generative AI” or “Gen-AI”. In the 1950 paper “Computer Machinery and Intelligence”, Alan Turing introduced the concept of a “Turing Test”, requiring that a human should be unable to distinguish the machine from another human being by using the replies to questions put to both. Building on the work of Alan Turing, computer scientists at firms such as IBM employed “Machine Learning”, which was essentially taking historical data to train a model to then “predict the future”. A subset of Machine Learning, “Deep Learning”, was subsequently created, using layers of algorithms to process data, and imitate the thinking process. These layers, or “Neural Networks”, were created to imitate the synapses in human brains, also organised in layers. Finally, Gen-AI emerged as a subset of deep learning. What was unique about Gen-AI was its ability to generate content- first predict a number, then a classification, and with increasing complexity, write a book. In February of this year, a team at the Stanford School of Humanities and Sciences announced that the most recent version of the ChatGPT “Chatbot”, version 4, was not distinguishable from its human counterparts, essentially passing the “Turing Test”. Some clients have asked what is the connection between generative artificial intelligence and Nvidia – Nvidia designs the semiconductor chips needed to power the data processing, selling their newest H100 “Blackwell chip” for about $25,000 each.

OpenAI, which created ChatGPT, was founded in 2015. OpenAI was originally founded as a counterpoint to Alphabet and Meta, which had both invested significant sums in artificial intelligence research. The initial premise was for OpenAI to remain a non-profit, although it quickly became apparent that the funds required to continue the research required the backing of a company with significant access to capital. As a result, Microsoft developed a partnership with OpenAI in 2016, who subsequently chose Azure (Microsoft servers) to host ChatGPT4 and the newest version, “4-Turbo”. Pascal highlighted that what made ChatGPT different was the speed with which the consumer had adopted Gen-AI and interacted with it. Whereas facial recognition had included AI technology, it did not have a significant consumer uptake. ChatGPT, however, now has 111 million daily web visits (according to Bank of America Data). When ChatGPT was released, all the responses were driven through Microsoft’s Bing, which represented a renewed challenge to Alphabet’s 91% global search market share (Bing’s global search engine share is 3.7%). While Alphabet have subsequently maintained their search engine dominance, Alphabet continues to invest significantly in tools which are similar to ChatGPT. Meta has also continued investing in the field, in 2022 hiring SynerAI Board Member and Machine Learning Engineer Travis Nixon, showing that they, too would like to compete with Microsoft.

Gen-AI has many potential use cases; as an example, SynerAI uses the technology as an investing tool -creating “bullet point summaries” on companies using large datasets which better tailored to the investment universe when compared to the ChatGPT summaries. Furthermore, SynerAI use AI to create “Buy” or “Sell” signals for hedge funds based on 20,000 daily news articles published daily by journalists.

Gen-AI will also prove to be a source of new revenues for data companies such as a Thomson Reuters (Market Capitalisation $71bn, net income $1.6bn, Merrill Lynch-rated BUY). Thomson Reuters serves professionals within legal, tax and accounting professions with software tools to help their daily workflow. Last year Thomson Reuters added enhanced AI capabilities to its flagship legal product Westlaw, and it is now rolling out products that include Gen-AI, such as Ask Practical Law AI, Intelligent Drafting and Checkpoint Edge AI-assisted tax research. Over 5,000 law firms have access to Thomson Reuters’ Gen-AI tools now, and Thomson Reuters sees Gen-AI adding an extra $12bn in revenue potential (the firm’s current annual revenues are $7bn).

While many companies stand to benefit from further developments in Gen-AI, it is important to note that this market is in its infancy. Although many companies are also including “AI” in their earnings commentaries, Pascal was keen to point out that the leadership remains very much with Microsoft, which holds 49 percent equity in OpenAI and a significant advantage over its rivals. We are grateful that Pascal spent time explaining some of the core concepts around AI to us and wish him continued success with his AI-based startup, SynerAI.