2023 – Strong start to the year despite banking woes

2023 started on a positive note for equities as, despite the collapse of three banks in the United States including Silicon Valley Bank and the dramatic sale of Credit Suisse to UBS for $3.2bn, markets rose over the quarter. The S&P 500 rose by 7.5% while the Nasdaq, after declining 32% in 2022, rose by 21%. This increase also came as the yield on 2-Year US Treasury bonds declined from a high of 5% in early March to below 4%. The fact that the yield on 2-Year Treasury bonds is lower than the yield on 3-Month US Treasury bills (4.9%) signals that we are towards the end of the rate hiking cycle.

Why did markets rise over the quarter? Better than “feared” earnings could have helped. In 2022, analysts witnessed the twin evils of declining price to earning “multiples” as well as declining earnings expectations for 2023. For example, Microsoft’s expected 2023 earnings declined from almost $11/share in January 2022 to just over $9 today. At the same time, its price to earnings ratio declined from 31x in November ’21 to a low of 23x earlier in the quarter. At the 31st March close price of $288, Microsoft’s shares are now close to the November ’21 level of 31 times 2023 earnings and the popularity of ChatGPT has encouraged analysts to look forward to a new era of innovation.

Changing currency rates, which proved a headwind in 2022, may reduce their negative impact this year. Luxury manufacturer Hermes, which rose 32% in USD terms in the first quarter, was able to celebrate strong sales growth of 23% for the 2022 calendar year. As an exporter of primarily France-manufactured luxury products, the weaker Euro proved to help sales in 2022. Management remains optimistic for the company’s prospects in 2023, and this optimism was shared by many European exporters. This year, even a moderation of US dollar strength could help companies in the S&P 500, where at least 30% of earnings fall outside of the US.

The end of June will mark 18 months of a “bear market” in equities, where equity valuations fall at least 20% from their all-time highs. Unusually, this bear market coincided with a difficult period for bondholders. One of the benefits of this period of depressed sentiment is that both earnings expectations and valuations have moderated, giving companies lower targets to meet, and rewarding shareholders with improved earnings yield.

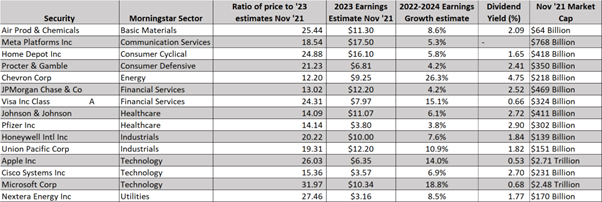

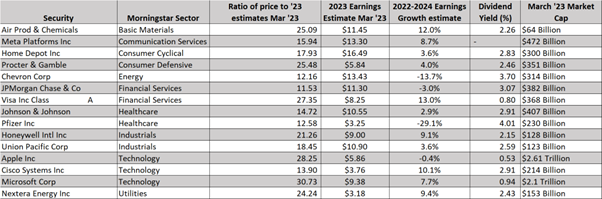

Below is a list of 15 shares across different sectors. The first table shows how analysts viewed these companies in November 2021. These companies were, on average, trading at almost 21 times 2023 earnings, with two year annualized earnings growth projected to be 10% (ahead of average earnings growth since 1962). As at the 31 March, this same group is trading at just under 20 times 2023 earnings. In most cases, analysts have reduced their earnings estimates for 2023 as well as dramatically reduced the 2022-2024 growth rate estimate to 2.5% (well below the NYU Stern average of 8% since 1960). Moreover, the dividend yield has improved by 20% in the period (from 2% to 2.4%). These figures are reminders that lowered valuations and lowered expectations could be helping to sow the seeds of the next bull market.

Analyst Expectations November ‘21

Analyst Expectations March ‘23

Source: KDT, BAML, UBS

Staying Invested

We have heard investors say that they are waiting for the perfect moment to buy shares. Many are pointing to an index level – for example if the S&P 500 were to fall 10%/20%/30%/50% from today’s levels. All of the above levels have been cited by respected market strategists as the “fair value” for the index at varying times in the last eighteen months.

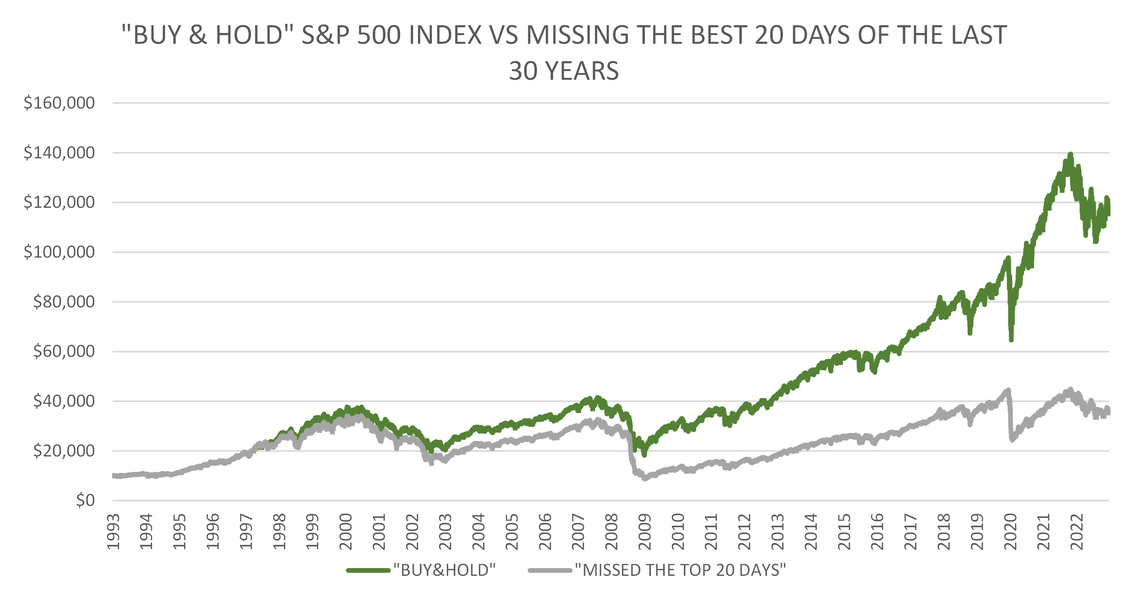

Although this approach sounds good in theory, it is fraught with opportunity costs. The below chart shows the difference between an investment in the S&P 500 over the last thirty years where, in green, the investor held on to the index investment over the entire period and where, in grey, an investor missed only the best twenty days of the last thirty years.

Source: KDT, Yahoo Finance

Even if an investor had missed but five trading days in the last thirty years, they would have been $30,000 poorer on a $10,000 initial investment versus an investor who had remained fully invested the entire time.

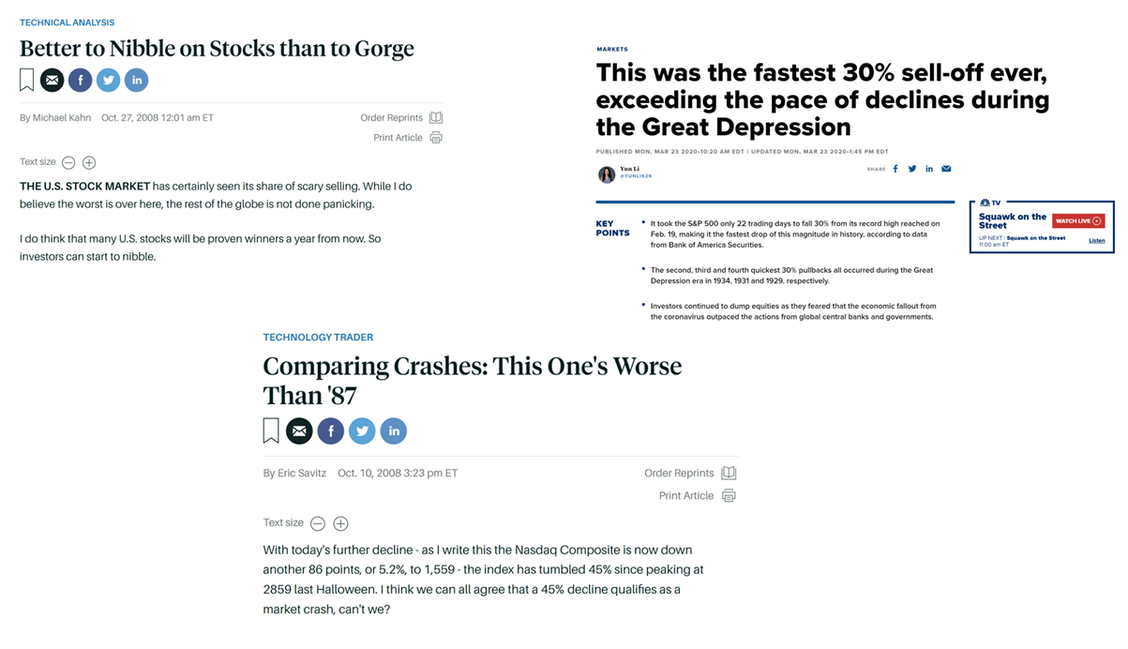

One might argue that, “of course”, most rational investors would have been in the market during those best twenty days. Often, however, those best days occur in the teeth of a bear market. Looking at some example headlines from Barron’s and CNBC the day before these all important “top days” suggest that investors do not get fair warning.

Headlines the day before three of the best days in the last 30 years

Source: Barron’s, CNBC

Power of Dividends

Berkshire Hathaway’s annual report continued to be an engaging read this year. One of the subjects Warren Buffett touched upon was the power of dividends.

In August 1994, Berkshire completed its seven-year purchase of 400 million shares of Coca-Cola for a total cost of $1.3billion. At the time, this was a very meaningful sum of money to Berkshire. The cash dividend Berkshire received from Coke in 1994 was $75million. By 2022, the annual dividend had increased to $704million. As Buffett acknowledged, “growth occurred every year, just as certain as birthdays”.

American Express is a similar case: Berkshire’s purchases were essentially completed in 1995 and also cost $1.3bn. Annual dividends received from this investment have grown from $41m to $302m.

For Buffett, these dividend gains, though pleasing, “are far from spectacular”. As the dividends have grown, the value of the investment has also increased. At year end, Berkshire’s Coke investment was valued at $25bn while Amex was recorded at $22bn. As he writes “the lesson for investors: the weeds wither away in significance as the flowers bloom. Over time, it takes just a few winners to work wonders. And yes, it helps to start early and live into your 90s as well”.

We currently monitor $256m of direct equity investments where we have historic cost information. Of these assets, approximately $89 million consists of positions where the unrealized gain on the investment is greater than 100%. Of this group, $5m consist of investments where the annual dividend is greater than 20% of the original purchase cost. We are confident that this number will increase over time. Unfortunately there are no short cuts; it takes time for a “blue chip” company’s annual dividend to become a significant portion of one’s original investment. As Warren Buffett has written previously, “the stock market is a device for transferring money from the impatient to the patient”.