Strong Fourth Quarter includes 12th biggest 2-month rally since 1950

The S&P 500 total return index returned 26% for 2023 following an 18% decline in 2022. The Dow Jones, which declined by 7% in 2022, rose by 16% in 2022. The Nasdaq, which declined by 32% in 2022, rose by 45% in 2023. In November and December, the S&P 500 index gained by 13.9%, the 12th biggest 2-month rally since 1950.

Apple added $1trillion to its market capitalization, while Microsoft and Nvidia added close to $750bn. After 2022, when technology shares declined more than 27%, the sector rose 45% over 2023. Communication services rose by 31% and the iShares US Home Construction ETF (largest positions are DR Horton 15% and Lennar 12%) rose by 68%.

2023 was a year in which interest stayed elevated: US 3-month treasury rates, followed by US 10-year treasury rates, hit highs of over 5%, levels not witnessed since before the Global Financial Crisis in 2008. Despite US banks benefiting from record net interest income (JP Morgan alone, for example, is expected to record over $90bn in net interest income in 2023), the rise in interest rates contributed to the largest US bank failure (Silicon Valley Bank) and the first rescue of a global bank (Credit Suisse) since the 2008 Financial Crisis.

One of the key themes for 2024 is the growing consensus amongst investors and investment banks that interest rates will start to decline. With regards to this, we are reminded of a quotation from Benjamin Graham and David Dodd’s book Security Analysis, first written in 1934: “We are skeptical of the ability of any paid agency to provide reliable forecasts of the market action of either bonds or stocks. Further, we are convinced that any combined effort to advise …upon the course of bond prices is fundamentally illogical and confusing. Much as the investor would like to be able to buy at just the right time and to sell out when prices are about to fall, experience shows that they are not likely to be brilliantly successful in such efforts and that by injecting the trading element into their investment operations they will disrupt the income return on their capital and inevitably shift their interest into speculative directions”.

Investing at all-time highs?

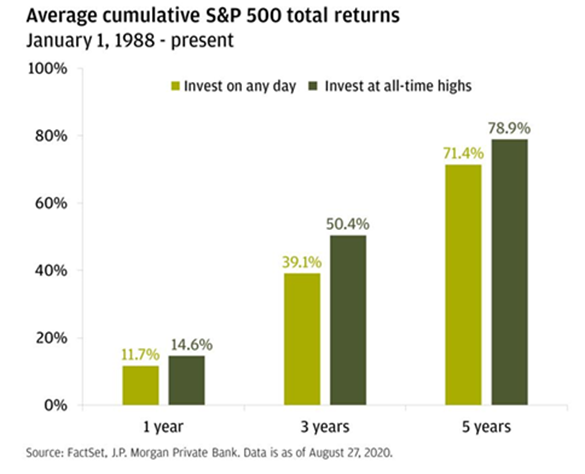

The S&P 500 index closed at 4,770 on the 29th December, ensuring that 2023 was the first year since 2012 where the S&P 500 did not reach a new all time high. We are not far off, however, from the record high of 4,796 reached on the 3rd January 2022. One of the great questions received from a client this quarter was “is it better or worse to invest at all time highs? Intuitively, investors could be forgiven for believing that these are historically bad times to invest. This is not necessarily supported by the evidence:

JPMorgan looked at 30 years of index returns from January 1, 1988 to August 27, 2020, and concluded that the average 1 year index return of 11.7% was improved on when investing at all-time highs. When only investing on days when the S&P 500 closed at an all-time high, the index made money over the course of the next year 88% of the time, and the average total return was +14.6%.

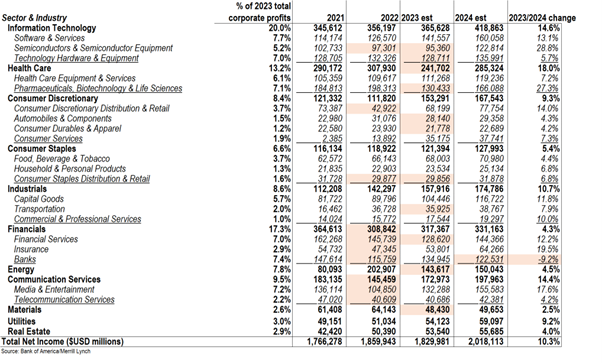

Source: BofA US Equity and US Quant Strategy

Many professional investors do not focus on the absolute level of the S&P 500 index, focusing instead on the ratio between forecast earnings and the index level. Yardeni research’s team estimate 2024 earnings for the S&P 500 index to be $250. This amounts to an earnings “yield” (earnings divided by price) of 5.24%. While this is below the average since 1960 of 7%, it is only slightly below this century’s average of 5.7%. Since 1960, there have only been six years where the earnings yield started between 5% and 5.6%, with an average annual return of 9% (below the sixty-year average of 12%) and only one negative year (1962).

The index level is therefore less important than the ratio of earnings to the index. It is for this reason that investors will also wish to focus on any signs that corporate earnings are in decline.

US corporate earnings data provided by Bank of America/Merrill Lynch, suggest that 2024 will be a good year for earnings, in particular when compared with 2023. The below table has sector earnings in bold, followed by industry earnings below. The cells shaded lightly in red are those years and sectors/industries where earnings declined from the previous year. 2023 witnessed declines in some sectors such as energy, healthcare and materials, while the more cyclical semiconductor and financial services industry witnessed their second year or earnings decline. 2023 also witnessed a recovery for the Communications sector, where earnings grew by 19%, led by Alphabet with $73bn of earnings and Meta with $37bn.

Although 2023 was a year where earnings stagnated, the earnings picture for 2024 remains healthy with signs of broad growth across sectors.

Charlie Munger

Charlier Munger passed away on the 28th November at the age of 99 years (he would have turned 100 today). He was the vice chairman of Berkshire Hathaway, the conglomerate controlled by Warren Buffett. Buffett described Munger as his closest partner and “right-hand man”.

One month before his death, Munger participated in his first (and, unfortunately, last) podcast interview with Acquired. The full transcript is here, but we have some themes below:

Costco

Munger is credited with helping Buffett move away from a strategy of only buying undervalued securities and focusing on buying “wonderful companies at a fair price”. This is something that Munger truly believed in, and much of the conversation centered around some of Munger’s favourite companies. One of Munger’s favourite companies (and most successful investments) was Costco. Munger mentioned that “there aren’t many times in a lifetime when you know you’re right and you know you have one that’s really going to work wonderfully. Maybe five or six times in a lifetime you get a chance to do it. People who do it two or three times early, all go broke because they think it’s easy. In fact, it’s very hard and rare”.

Munger believed that Costco’s business model was very effective: “they really did sell cheaper than anybody else in America, and they did it in big, efficient stores. The parking spaces were 10 feet wide instead of eight or nine feet or whatever they normally are”. For Munger, one of the reasons why Walmart was not able to compete effectively with Costco was that “they were too weathered by the ideas that they already had. That’s everybody’s trouble. They can’t accept a new idea because the space is occupied by the old idea. They got into the habit of getting real estate for practically nothing, because they went into towns where nothing is valuable. So (Walmart’s) occupancy costs are like zero…that was their formula…So it offended them to go against the rich suburbs and have to pay for the good locations. Costco just specialized in the good locations, where the rich people lived. And Walmart just let them do it year after year. It was just a terrible mistake”. Munger was, however, keen to stress that although the formula may have seemed “obvious”, it was about keeping going year after year: “you really have to set out to do it, and then do it with fanaticism, every day, every week, every year for 40 years. It’s not so damn easy”.

Brands

The conversation also covered brands in general. Munger observed that “a lot of professional investors buy nothing but branded goods. They usually start with this Nestlé…and they’ve done two or three points better than average, but it’s not a bonanza”. Munger was very positive about branded goods in general; “it’s hard for us not to love brands…since we (Berkshire Hathaway) were lucky enough to buy See’s candy for $20million as our first acquisition. We found out fairly quickly that we could raise the price every year 10% and nobody cared. We didn’t make the volumes go up or anything like that. Just made the profits go up. We’ve been raising the price by 10% a year for all these 40 years or so. It’s been a very satisfactory company”. Buffett observed in his 2007 annual report that See’s pre-tax earnings since its acquisition in 1972 had totalled $1.35billion to that point, with only $32million reinvested into the business.

Charlie also mentioned Hermes as an example of a good company: “if you’re as good at what they’ve done, you have a lifetime to do it in. Without a lifetime, three or four lifetimes to do it in. You can create another, but it’s not easy”. It is worth noting that the price at which shares were bought remained important for Munger- he was only a buyer of Hermes “at a price cheap enough”, and value remained a key part of his investment philosophy. He returned to value when talking about Berkshire’s $30billion investment in Apple (now worth $174billion) – “what everybody has learned is that everybody needs some significant participation in the 12 companies that do better than everybody else (this is in reference to companies such as Amazon, Apple, Alphabet, Microsoft, Meta, Tesla and Nvidia). You need two or three of them, at least”. Munger supported an investment in Apple for example, because “it got cheap. It got to about 10 times earnings when Warren bought in”.

Last Thoughts

As the interview ended, Munger broadened out the discussion onto a range of topics- he continued to question the validity of EBITDA as a metric for assessing business performance: “You’ve got a big truck company and take the depreciation out of the truck’s earnings. You’re lying about the earnings”. He also emphasized that the future is unknowable: “a lot of companies are pretty good, but you can’t confidently say what’s going to happen. Because you may get some guy like (Disney CEO Bob) Iger (who) just wants push everything and do the right public relations. So no matter how good the business is, it will be phony”. He continued to reiterate that investing is hard- “why should it be easy?”, but that the “beauty of it is: you only have to get rich once. You don’t have to climb this mountain four times. You just have to do it once”.