Stocks tread water as US long-term interest rates rise

The S&P 500 index of stocks declined -3.32% over the last quarter, as weaker markets in August and September more than offset a strong July. Declines were led by the Technology sector, where Apple and Microsoft declined by 12% and 8% respectively. Despite a good earnings report in August, where Apple set a record in service revenue driven by more than 1 billion paid subscriptions, Apple’s share price was affected by trade tensions between the US and China as well as uncertainty over the iPhone 15 launch cycle. The US and China together account for 58% of total App store revenue with the US accounting for 32% and China accounting for 26%. Microsoft’s earnings results were resilient, including 27% growth in their Azure cloud business.

The Bank of America Fund Manager survey, recorded in September 2023, underlined that inflation and central banks maintaining a restrictive monetary policy remained the primary concern amongst professional investors, with Chinese real estate jumping to the number one source for a systemic credit event, overtaking US commercial real estate. Investors have also taken onboard the US Federal Reserve’s message that interest rates will remain “higher for longer”, with the majority now arguing that the 1st Fed rate cut will occur between April and December 2024. The rising US 10-year treasury yield in the second half of the quarter also took investors by surprise, with the 10-year US Treasury now offering over 4.5%, a 16-year high.

Some of the rising US treasury yields could be ascribed to an investor belief that inflation may not be over, and this was supported by Brent Oil’s rise to $92, below the highs of May 2022 but a 27% increase from May 2023’s price of $72.60. Energy shares benefited from this price increase, in particular refiners such as Valero and Marathon Petroleum which rose 33% and 26% over the quarter respectively. Refiners are benefiting a shift in crude exports, as Saudi Arabia has cut its oil production to 9million barrels a day.

Amgen was the best performing stock in both the Dow Jones Industrial Average and the Nasdaq 100 in the third quarter- shares of the biotechnology company received a boost after Amgen posted better than expected second quarter earnings and revenue. On September 1st, The Federal Trade Commission reached a deal with Amgen that approved the company’s $27.8billion acquisition of Horizon Therapeutics, with restrictions meant to limit the possibility of reduced competition to the biopharmaceutical industry. News that the UK competition commission was removing its objections to Microsoft’s $69billion purchase of Activision Blizzard, as well as Cisco’s announcement of its offer to buy Cybersecurity firm Splunk for $28billion in cash, were overall positive signs for the market.

Higher interest rates bring more competition for shares

According to the US Bureau of Labor Statistics, the Consumer Price Index of all items increased 3.7% before seasonal adjustment over the twelve months up to the 13th September 2023. Seven days later, on the 20th September, Federal Reserve Board members projected that short term interest rates would stay above 5% for all of 2024. On the 31st of August, the US Treasury issued a two year Note paying interest of 5%. The ability now to achieve a rate more than inflation, which is the desire of many savers, simply by lending to the US government has turned treasuries into a compelling alternative. According to research from Bank of America, investment advisors are now favoring fixed income over equities for the first time in at least six years.

Source: BofA US Equity and US Quant Strategy

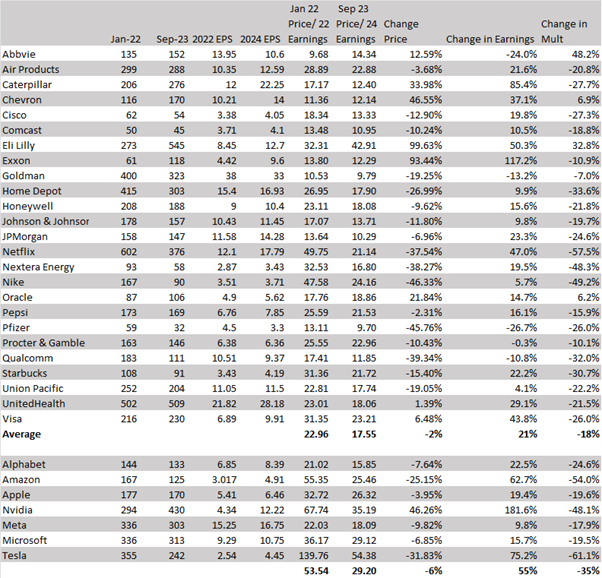

Analysts expect earnings for the S&P 500 index next year to be $250, an earnings “yield” of approximately 5.9% on the index’s close of $4,238 as at the 30th September. The 1% difference in the return between the earnings yield of the stock market and what is available for short-term treasury investors is more modest than in previous years. Given this “new” alternative and the additional volatility in shares, we would expect that the earnings yield required by investors should drift upwards over time. This has already happened to some extent: a review of 32 large companies shows that, when compared to January 2022, the group’s earnings have increased and their price earnings multiples have decreased, offering better value than in early 2022. The discounting, or change in multiple, has been most pronounced in the “Magnificent Seven” stocks Apple, Microsoft, Amazon, Nvidia, Google, Tesla & Meta. On average, these shares are trading at 29x 2024 earnings – in late 2021, this group was trading at 53x the next year’s earnings.

In the eight years where interest rates finished between 5% and 6% (1968, 1975, 1986-7, 1995-7, 2000), the average forward earnings “yield” was 6.64%, slightly above today’s earnings yield, but suggesting that the market is perhaps not significantly overvalued by historical standards.

Source: KDT. Bank of America. Note that the 2022 EPS figure was taken from expectations in late 2021/early 2022. By the middle of 2022, the Ukraine war and continued inflation had considerably shifted earnings expectations for the year.

Savita Subramanian – BofA Securities

Savita Subramanian is a managing director, global head of Environmental, Social & Governance (ESG) Research and head of US Equity and Quantitative Strategy at Bank of America and based in New York. She has been ranked in the Institutional Investor survey for the last ten years.

In a recent interview, Subramanian highlighted that September’s 4.9% stock market decline is normal by historical standards- 5% declines occur three times a year on average using data going back to the 1920s. She believes that the market is perhaps recalibrating the idea that rates may not be declining any time soon. For her, it is interesting that the best performing sectors recently have been energy and healthcare, which she terms the “stagflationary duo”- higher oil prices benefit energy stocks, whereas healthcare is seen as a defensive sector which remains resilient during economic declines.

Savita feels positive that the stock markets will end the year marginally higher at 4,600. The S&P 500 has basically “bought itself some time to adapt to a higher interest rate environment”. If you look at the companies in the S&P 500, they have dramatically reduced their floating rate debt exposure. Following the financial crisis in 2008, both US homeowners and companies reduced their floating rate risk. 85% of US homeowners have fixed rate long dated mortgages, while 80% of debt on corporate balance sheets is fixed rate. This means that companies have time to adapt to the new higher rate, higher inflation environment. Over the last few years, she has observed companies looking to do more with fewer people – companies have been spending more on automation. This is a key advantage she sees that companies have over bonds – companies have more options relative to long bonds, which are, by definition, a fixed return over a fixed duration.

Over the first quarter of the year, a lot of the larger companies such as Alphabet and Meta, did “what they should have done- admitted that they had overbuilt capacity, downsized their labour forces and cut a lot of costs”. These companies then initiated share buybacks, which pulled the cashflow returns for investors forwards. In a higher interest rate environment, companies that are able to return cash faster to investors may be preferred given the higher rates available on cash.

Subramanian has forecast that the “equal-weighted” S&P 500 index will outperform the S&P 500 index by 5% a year for the next decade. Note – the S&P 500 index is weighted by market capitalization, which means that the largest companies, such as Apple and Microsoft, have a higher weighting in the index and have more of an impact on returns. An “equal-weighted” index would give each company in the S&P 500 index the same impact on returns. Subramanian believes that, ultimately, valuation is the most important driver of long-term returns, and right now the valuations for the equal-weighted benchmark are that much more attractive than the valuations for an index based on market capitalization.

Hendrik Bessembinder calculates that Apple has the greatest lifetime wealth creation (nearly $2.7trillion) of all the stocks of US companies from 1926 to 2022. The company went public in late 1980 and the IPO was banned in Massachusetts because it was deemed to be “overpriced”